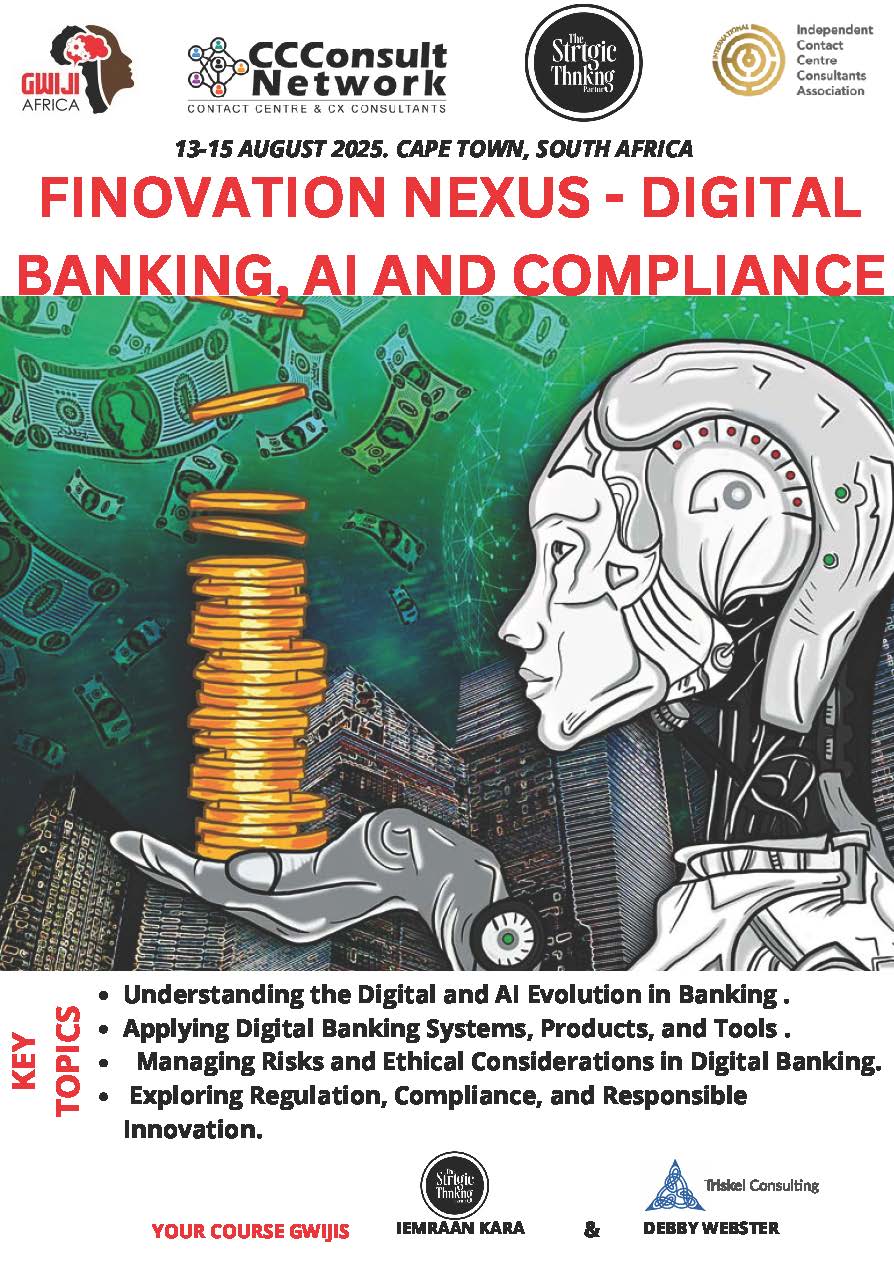

FINOVATION NEXUS - DIGITAL BANKING, AI AND COMPLIANCE - 13th-15th August 2025, CapeTown - South Africa

Dates: 13-15 August 2025 CapeTown, South Africa.

Investment :$ 1,285

Rationale

Financial institutions must keep up with AI and digitalization to remain competitive, efficient, and secure in a rapidly evolving market. The rationale behind this includes:

Investment :$ 1,285

Rationale

Financial institutions must keep up with AI and digitalization to remain competitive, efficient, and secure in a rapidly evolving market. The rationale behind this includes:

- Enhanced Customer Experience

- AI-powered chatbots, personalized recommendations, and digital banking improve customer service.

- Faster transactions and seamless mobile banking increase convenience.

- Operational Efficiency & Cost Reduction

- AI automates manual tasks, reducing errors and operational costs.

- Digital processes minimise paperwork, improving speed and accuracy.

- Fraud Detection and Risk Management

- AI analyses patterns to detect and prevent fraudulent activities in real-time.

- Risk assessment models improve decision-making for loans and investments.

- Regulatory Compliance and Security

- Digital solutions help institutions comply with ever-evolving regulations.

- AI-driven cybersecurity protects against cyber threats and data breaches.

- Competitive Advantage and Market Adaptation

- AI and digitalisation help institutions stay relevant.

- Advanced analytics provide insights for better business strategies.

- Financial Inclusion and Accessibility

- AI-driven banking services reach unbanked and underbanked populations.

- Digital platforms offer financial services beyond physical branches.

- Data-Driven Decision Making

- AI processes large volumes of data to uncover trends and predict market shifts.

- Banks use analytics to personalise offers and optimise investments.

- Commercial Awareness – Understanding how AI and digital tools affect business performance and customer value.

- Cybersecurity Fundamentals – Recognising digital vulnerabilities and supporting safer service delivery.

- Data and Digital Literacy – Interpreting customer and operational data to support informed banking decisions.

- Leadership and Influencing – Advocating for responsible innovation and cross functional collaboration.

- Problem Solving – Addressing practical challenges in service design, compliance, and customer experience.

- Self-Directed Learning – Building adaptive thinking and continuous development mindsets in a fast-changing digital landscape.

- All bank employees regardless of their specialisation, who want to expand their knowledge and understanding of digital, AI, and automated banking.

- General banking staff from operations, customer service, sales, compliance, IT, or administrative roles who want to stay future-fit in an increasingly digital environment.

- Team leaders and supervisors looking to apply digital tools to improve customer service (CS), customer experience (CX), and operational efficiency.

- Early-career professionals and interns who are entering the workforce and require foundational digital banking and AI fluency to support innovation and adaptability.

- Afrillennials, as the gateway generation, and multi-generational talent seeking to strategically bridge generational shifts in technology adoption, customer preferences, and service delivery.